| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to240.14a-12 |

| ☑ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |

Notice of and Proxy Statement

|

April 28, 202329, 2024

Dear Fellow Shareholders:

Please join us for the HCI Group, Inc. Annual Meeting of Shareholders on Thursday,Tuesday, June 8, 2023,11, 2024, at 3:00 p.m. (Eastern time). Doors open at 2:30 p.m. We will host our meeting at ourHCI’s headquarters located east of downtown Tampa, at 3802 Coconut Palm Drive, Tampa, Florida 33619.

In 2022,2023, HCI continued to make progressexecute on several key initiatives and the Company remains on a path to reaching our strategic priorities: growing TypTap Insurance Company, expanding our company footprint,long-term objectives, including profitable growth and managingprudent management of our balance sheet. In this year’s proxy statement, we discuss our financial highlights and frameworks for governance and compensation. We also expandedcontinue to actively seek feedback through our disclosure around shareholder engagement and executive compensation.efforts. The Compensation Committee believes that additional disclosure around our multi-year awards under our long-term compensation program,plan continues to align with the absencefinancial performance of any new awards in 2022, and our continuing research of new performance-based pay structures constitute meaningful action aimed at addressing concerns raised by shareholders in 2022.the Company. We look forward to continuing an active dialog with our shareholders through our ongoing outreach efforts.

Our proposals this year include:

To elect Class CA Directors,

To ratify the appointment of external auditors, and

To approve, on an advisory basis, the compensation of the named executive officers

We value input from each of our shareholders and encourage you to vote your proxy. Please read the accompanying Proxy Statement and follow the voting instructions it contains so your votes will be counted.

On behalf of the Board of Directors of HCI Group, I thank you for your investment in HCI.

Sincerely,

Paresh Patel

Chairman of the Board

Chief Executive Officer

3802 Coconut Palm Drive

Tampa, Florida 33619

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Thursday, June 8, 202311, 2024

3 p.m. Eastern time

HCI Corporate Headquarters

3802 Coconut Palm Drive

Tampa, Florida 33619

The Annual Meeting of Shareholders of HCI Group, Inc. will be held at 3 p.m. Eastern time on Thursday,Tuesday, June 8, 202311, 2024 at HCI Corporate Headquarters, 1st Floor Auditorium, located at 3802 Coconut Palm Drive, Tampa, Florida 33619. Shareholders will be admitted beginning at 2:30 p.m. The principal purposes of the Annual Meeting will be to cover the following items of business:

| 1. | To elect Class |

| 2. | To ratify the appointment of FORVIS, LLP as our independent registered public accounting firm for the year ending December 31, |

| 3. | To approve, on an advisory basis, the compensation of our named executive officers |

| 4. | To transact such other business that may properly come before the meeting or any adjournments or postponements thereof |

You may vote if you were a shareholder of record as of April 12, 2023.15, 2024.

Our 20222023 Annual Report to Shareholders which is not a part ofaccompanies this Proxy Statement, is enclosed.Statement.

It is important that your shares be represented at the Annual Meeting and voted in accordance with your instructions. Please indicate your instructions by promptly signing and dating the enclosed proxy card and mailing it in the enclosed postage-paid, pre-addressed envelope, or by following the instructions on the proxy card for telephone or internet voting.

By Order of the Board of Directors,

Andrew L. Graham

Secretary and General Counsel

TABLE OF CONTENTS

| PROXY STATEMENT SUMMARY | 1 | ||||||

| 1 | |||||||

| 1 | |||||||

| 1 | |||||||

| 2 | |||||||

| IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS | 2 | ||||||

| FINANCIAL HIGHLIGHTS | 3 | ||||||

| SHAREHOLDER ENGAGEMENT | 5 | ||||||

| GOVERNANCE HIGHLIGHTS | 7 | ||||||

| MATTER NO. 1: ELECTION OF DIRECTORS | 8 | ||||||

| 9 | |||||||

| 9 | |||||||

| 9 | |||||||

| 10 | |||||||

| 11 | |||||||

| 11 | |||||||

| 12 | |||||||

| 12 | |||||||

| 13 | |||||||

| 23 | |||||||

| 24 | |||||||

| MATTER NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |||||||

| MATTER NO. 3: APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | |||||||

Role of the Board of Directors, Management and Consultants in Compensation Decisions | |||||||

| 38 | |||||||

Pension or Other Retirement Plan and Deferred Compensation Plans | 39 | ||||||

| 40 | |||||||

| 41 | |||||||

| 42 | |||||||

| 42 | |||||||

| 43 | |||||||

| 43 | |||||||

| 44 | |||||||

| CORPORATE GOVERNANCE | 48 | ||||||

| 48 | |||||||

| 48 | |||||||

| 49 | |||||||

| 49 | |||||||

| 52 | |||||||

| 54 | |||||||

| 54 | |||||||

| 54 | |||||||

| 55 | |||||||

| 55 | |||||||

| 55 | |||||||

| 55 | |||||||

| 55 | |||||||

| 56 | |||||||

| 56 | |||||||

| 56 | |||||||

| 56 | |||||||

| 56 | |||||||

| 57 | |||||||

Shareholder Proposals for Presentation at Next Year’s Annual Meeting | 57 | ||||||

| ABOUT THE ANNUAL MEETING | 58 | ||||||

| FORWARD-LOOKING STATEMENTS | 62 | ||||||

| APPENDIX | |||||||

| A-1 | |||||||

PROXY STATEMENT SUMMARY

This summary highlights information that can be found elsewhere in this Proxy Statement. It does not contain all the information that you should consider. You should read the entire Proxy Statement before voting.

Information About the Annual Meeting

Annual Meeting of Shareholders | ||

Time/Date | 3 p.m. Eastern time on | |

Place | HCI Corporate Headquarters, 3802 Coconut Palm Drive, Tampa, Florida 33619 | |

Record Date | April | |

Mailing Date | We began mailing this Proxy Statement on or about | |

Items of Business

Item | The Board’s Recommendation | Page | ||||

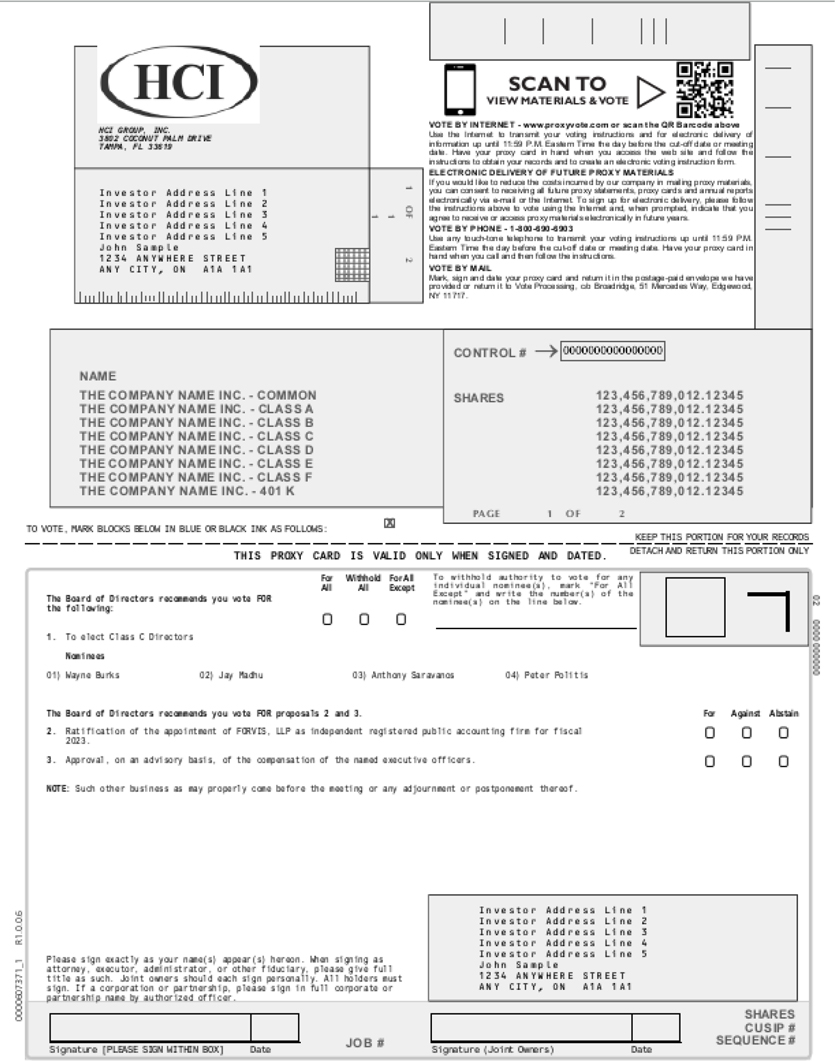

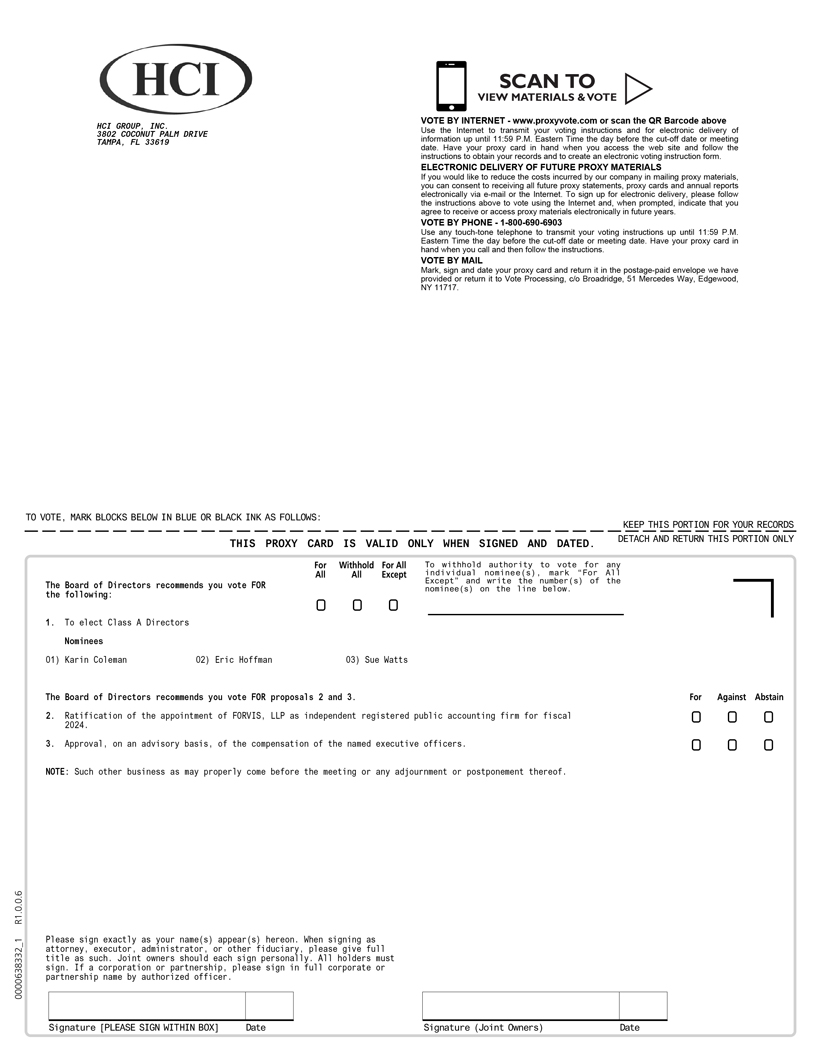

1) To elect Class | Vote FOR All | 8 | ||||

2) To ratify the appointment of FORVIS, LLP as our independent registered public accounting firm for the year ending December 31, | Vote FOR | |||||

3) To approve, on an advisory basis, the compensation of our named executive officers | Vote FOR | |||||

We do not anticipate that any other business matters will be brought before the meeting for a vote. However, if any other matters are presented, it is the intention of the persons named in the proxy card accompanying this proxy statement to vote the proxy as recommended by the Board of Directors or, if no recommendation is given, in their own discretion using their best judgment.

How to Vote

| By Internet | By Phone | By Mail | In Person | |||

|  |  |  | |||

| www.proxyvote.com | Call the phone number listed on your proxy card | Follow the instructions on your proxy card | Vote by ballot at our Annual Meeting | |||

Call the phone number listed on your proxy card or HCI’s proxy advisor, Alliance Advisors LLC, at 844-618-1694 (toll free in the United States).

| HCI Group, Inc. | 1 |

PROXY STATEMENT SUMMARY

Annual Meeting Rules of Conduct

To ensure fair, orderly and constructive meetings, the Board of Directors has adopted rules of conduct for shareholder meetings, including that only shareholders of record as of the record date or their duly authorized representatives are entitled to vote or address the meeting; no one may address the meeting unless called upon by the presiding officer of the meeting; and the use of cameras, audio or video recording equipment, communications devices or similar equipment is prohibited. Individuals who violate these rules may be removed. (See “About the Annual Meeting: Are there rules of Conduct?”)

Important Notice Regarding Availability of Proxy Materials

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on June 8, 202311, 2024

This Proxy Statement and the 20222023 Annual Report to Shareholders are available at

http://www.hcigroup.com/2023proxymaterials/2024proxymaterials/

Upon your written request, we will provide you with a copy of our 20222023 Annual Report on Form 10-K, including exhibits, free of charge. Send your request to HCI Group, Inc., c/o Simon Rosenberg, DirectorBill Broomall, Vice President – Investor Relations, 3802 Coconut Palm Drive, Tampa, Florida 33619.

| 2 | HCI Group, Inc. |

PROXY STATEMENT SUMMARY

FINANCIAL HIGHLIGHTS

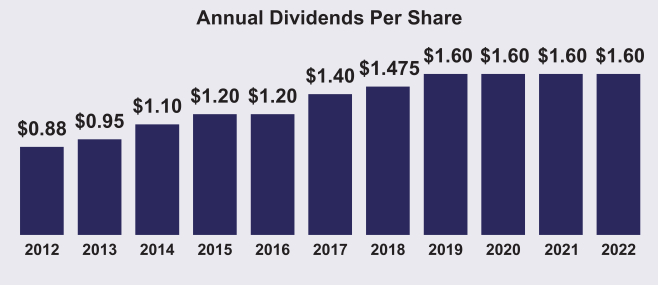

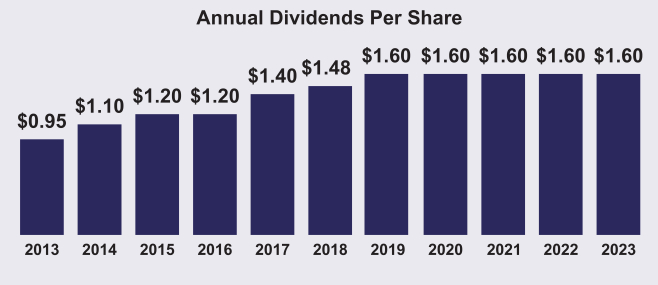

In 2022, HCI advanced its2023, we completed several strategic prioritiesinitiatives to growposition the businessCompany for further growth and increase the value of the Company while continuing to return capital to shareholders. TypTap Insurance Company, our technology-driven insurance subsidiary, grew gross earned premium 70% compared with 2021We increased shareholder equity through improved operating results and expanded its footprint to 13 states. We also strengthened our balance sheet through the issuance of $173consummated a common stock offering generating $85 million in convertible notes while returning $99 millionproceeds. During 2023, book value per share increased by 76%. We have fueled our premium growth with bulk assumptions of policies and created an insurance carrier to our shareholders through dividends and share repurchases. We accomplished all of this while also managing the extraordinary impact of Hurricane Ian, one of the costliest storms to make landfall in the mainland United States.serve a new market segment.

Over the past decade, HCI has delivered solid results for our shareholders. Our return on equity (ROE) has averaged 12%12.5% over this period, and we have reported strong levels of earnings before interest and taxes (EBIT), despite several hurricanes and storms that had a material impact on our core homeowners insurance business. The Company has been profitable in 5660 of the last 6165 quarters and has paid dividends in 5054 consecutive quarters.

Profitable in

|

increase in revenue, year over year

|

| ||||||

|

consecutive quarters of dividends

| $ paid in

| ||||||

| ||||||||||||

| HCI Group, Inc. | 3 |

PROXY STATEMENT SUMMARY

| 4 | HCI Group, Inc. |

SHAREHOLDER ENGAGEMENT

Each year we engage in robust and continuous dialog with our shareholders regarding various issues, including corporate governance, compensation and environmental and social matters. In 2022,2023, we made a concerted effort to increasesustained our strong level of engagement by reachingengagement. We reached out to shareholders representing approximately 78%65% of our outstanding common shares. Board members and our Investor Relations staff spoke with 23 shareholders representing nearly 55%over 32% of the Company’s outstanding common stock. These percentages exclude insider ownership of approximately 21%. During these conversations, we discussed our Board composition, corporate governance policies and executive compensation practices, as well as our policies on corporate social and environmental responsibility.

|

| 100% of engagement involved the participation of at least one director

| ||||||

| HCI Group, Inc. | 5 |

SHAREHOLDER ENGAGEMENT

| Focus | Topics Discussed | What We Heard | What We Did | |||

Executive Compensation | Compensation Philosophy | Shareholders support a framework that aligns both long- and short- term compensation with the performance of the | The Compensation Committee reaffirmed its commitment to maintaining a strong relationship between pay and performance and continues to evaluate structures that support this philosophy. | |||

Corporate Governance | Board Structure | Shareholders expressed views on the structure of our | We reaffirmed our view that staggered, three-year terms provide continuity and enable directors to focus as a group on the Company’s long-term performance. All directors may be removed by a vote of the shareholders at any time, without cause. | |||

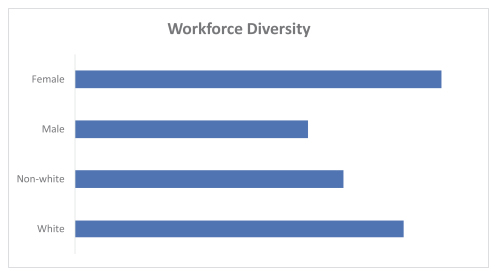

| Board Composition | Shareholders asked about the composition of our | HCI maintains a very diverse and active

| ||||

| Management Retention | Shareholders asked about efforts to retain certain key executives | Efforts were underway to enter into new multi-year employment agreements with a key executive. A new employment contract with our Chief Executive Officer was completed in April 2024. | ||||

Environmental and Social Matters | Disclosure | Shareholders asked for increased disclosure around ESG related policies. |

| 6 | HCI Group, Inc. |

GOVERNANCE HIGHLIGHTS

We are committed to maintaining a high standard of corporate governance to support the creation of shareholder value. We have a Lead Independent Director, a Board comprised of a majority of independent directors and a director share ownership requirement. More recently, theThe Board has established a Share Ownership Policy for the chief executive officer and createdall Board members. Additionally, a Sustainability Committee was created to assist the Board in its oversight of environmental and social policies.

We believe that a variety of perspectives, opinions and backgrounds among Board members is important to the Board’s ability to perform its duties. Our Board is diverse in terms of gender, ethnicity, culture, education and business backgrounds, and 80%50% of our boardBoard members contribute to gender or ethnic diversity.

We have a Code of Conduct to ensure that the conduct of our employees, officers and directors remains in compliance with laws, regulations and ethical principles. Employees, officers and directors are prohibited from engaging in derivative trading or hedging of our securities. We do not have a shareholder rights plan (“poison pill”).

Our executive compensation programs are designed to align the interests of our executives with those of our shareholders through a balanced mix of cash and long-term equity-based incentives that is benchmarked against our industry peers. We have a clawback policy that provides for pay reimbursement by an executive officer under appropriate circumstances.

| HCI Group, Inc. | 7 |

MATTER NO. 1 ELECTION OF DIRECTORS

FourThree directors are to be elected at the Annual Meeting. In accordance with the Company’s articles of incorporation, the Board of Directors is divided into three classes. All directors within a class have the same three-year term of office. The class terms expire at successive annual meetings so that each year a class of directors is elected. The current terms of director classes expire in 2023 (Class C directors), 2024 (Class A directors) and, 2025 (Class B directors) and 2026 (Class C directors). Each of the Class CA directors elected at the 20232024 Annual Meeting will be elected to serve a three-year term.

With the recommendation of the Governance and Nominating Committee, the Board of Directors has nominated the following persons to stand for election as Class CA directors at the 20232024 Annual Meeting of Shareholders, with terms expiring in 2026:2027:

Wayne BurksKarin Coleman

Jay MadhuEric Hoffman

Anthony Saravanos

Peter PolitisSue Watts

Each of the nominees for election as a director has consented to serve if elected. If, as a result of circumstances not now known or foreseen, one or more of the nominees should be unavailable or unwilling to serve as a director, proxies may be voted for the election of such other persons as the Board of Directors may select. The Board of Directors has no reason to believe that any of the nominees will be unable or unwilling to serve.

The persons named in the enclosed proxy card intend, unless otherwise directed, to vote such proxy “FOR” the election of Wayne Burks, Jay Madhu, Anthony SaravanosKarin Coleman, Eric Hoffman and Peter PolitisSue Watts as Class CA directors of HCI Group, Inc. The nominees receiving the fourthree highest “FOR” vote totals will be elected as directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR ELECTION OF EACH OF THE NOMINEES AS DIRECTORS OF THE COMPANY — ITEM 1 ON YOUR PROXY CARD. |

Full Board meetings in |

of the Board contributes to gender or ethnic diversity

|

of 10 directors are independent

| ||||||

| 8 | HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

Board of Directors

| Director | Independent | Age | Director Since | Primary Occupation | ||||||||||||

| Director | Independent | Age | Director Since | Primary Occupation | Nominees for Election: | |||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Nominees for Election: | ||||||||||||||||

Karin Coleman | ||||||||||||||||

Karin Coleman | No | 63 | 2021 | Chief Operating Officer, HCI Group Inc.; President, Homeowners Choice Property & Casualty Insurance Company, a subsidiary of HCI Group Inc. | ||||||||||||

Eric Hoffman | ||||||||||||||||

Eric Hoffman | Yes | 37 | 2021 | Senior Managing Director at Centerbridge Partners, L.P. | ||||||||||||

Sue Watts | ||||||||||||||||

Sue Watts | Yes | 62 | 2019 | President of Sapience Analytics Corporation | ||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Continuing in Office: | ||||||||||||||||

Paresh Patel | ||||||||||||||||

Paresh Patel | No | 61 | 2007 | Chairman and Chief Executive Officer, HCI Group, Inc. | ||||||||||||

Gregory Politis | ||||||||||||||||

Gregory Politis | Yes | 72 | 2007 | President, Xenia Management Corporation | ||||||||||||

Lauren Valiente | ||||||||||||||||

Lauren Valiente | Yes | 45 | 2021 | Lawyer; Of Counsel to Foley & Lardner LLP | ||||||||||||

Wayne Burks | ||||||||||||||||

Wayne Burks | Yes | 75 | 2013 | Retired; Former Director and Chief Financial Officer, at Romark LC. | Yes | 76 | 2013 | Retired; Former Director and Chief Financial Officer, at Romark LC. | ||||||||

Jay Madhu | Yes | 56 | 2007 | President and Chief Executive Officer, Oxbridge Re Holdings Ltd. | ||||||||||||

Jay Madhu | No | 57 | 2007 | President and Chief Executive Officer, Oxbridge Re Holdings Ltd. | ||||||||||||

Anthony Saravanos | ||||||||||||||||

Anthony Saravanos | No | 52 | 2007 | President, Greenleaf Capital, a subsidiary of HCI Group, Inc. | No | 53 | 2007 | President, Greenleaf Capital, a subsidiary of HCI Group, Inc. | ||||||||

Peter Politis | Yes | 44 | 2021 | Real Estate lawyer and principal at Xenia Management Corporation | Continuing in Office: | |||||||||||

Karin Coleman | No | 62 | 2021 | Chief Operating Officer, HCI Group Inc.; President, Homeowners Choice Property & Casualty Insurance Company, a subsidiary of HCI Group Inc. | ||||||||||||

Eric Hoffman | Yes | 36 | 2021 | Managing Director at Centerbridge Partners. | ||||||||||||

Sue Watts | Yes | 61 | 2019 | President of Sapience Analytics Corporation | ||||||||||||

Paresh Patel | No | 60 | 2007 | Chairman and Chief Executive Officer, HCI Group, Inc. | ||||||||||||

Gregory Politis | Yes | 71 | 2007 | President, Xenia Management Corporation | ||||||||||||

Lauren Valiente | Yes | 44 | 2021 | Lawyer; Of Counsel to Foley & Lardner LLP | ||||||||||||

Peter Politis | Yes | 45 | 2021 | Real Estate lawyer and principal at Xenia Management Corporation | ||||||||||||

Board Committee Memberships

| Director | Audit | Compensation | Governance & Nominating | Sustainability | ||||

Wayne Burks | Chair |

|

|

| ||||

Karin Coleman |

|

|

| Member | ||||

Jay Madhu |

|

|

| |||||

Eric Hoffman |

| Member |

| |||||

Paresh Patel |

|

|

|

| ||||

Gregory Politis |

|

|

| |||||

Peter Politis | Member |

|

| |||||

Anthony Saravanos |

|

|

| Member | ||||

Lauren Valiente |

| Member |

| Chair | ||||

Sue Watts | Member |

|

| |||||

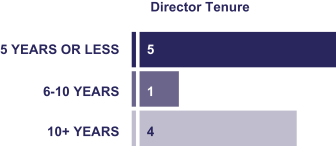

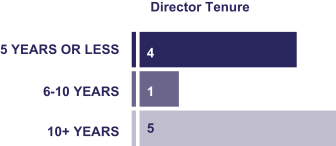

Director Tenure

Average tenure

years

| Average age

years

| |||

| HCI Group, Inc. | 9 |

MATTER NO. 1 ELECTION OF DIRECTORS

Board Selection Process

In accordance with the Company’s articles of incorporation, the Board of Directors is divided into three classes. Each class consists of three or four directors. All directors within a class have the same three-year terms of office. The class terms expire at successive annual shareholders’ meetings so that each year one class of directors is elected at the Annual Meeting. The Board does not believe arbitrary term limits on a director’s service are appropriate, nor does it believe that directors should expect to be re-nominated upon expiration of a three-year term. Each year the Board of Directors proposes a slate of nominees for election at the Annual Meeting. Directors may be removed by shareholders at any time with or without cause.

The Governance and Nominating Committee is tasked with identifying and selecting individuals believed to be qualified as candidates to serve on the Board and recommending to the Board candidates to stand for election as directors at the Annual Meeting or, if applicable, at a special meeting of the shareholders. The Governance and

| 10 | HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

Nominating Committee identifies director candidates in numerous ways. Generally, the candidates are known to and recommended by members of the Board of Directors or management. The Governance and Nominating Committee also considers director candidates recommended by shareholders. Shareholders may submit recommendations for Board nominees directly to the Board or at the Annual Meeting of Shareholders. See page 55 for information on submitting director nominations to the Board. A shareholder wishing to nominate an individual for election to the Board of Directors at the Annual Meeting rather than recommend a candidate to the Governance and Nominating Committee must comply with the advance notice requirements set forth in the Company’s bylaws, a copy of which can be found on the Company’s website, www.hcigroup.com, by selecting the “Investor Information” tab followed by “Corporate Governance.” Shareholders wishing to nominate an individual for election to the Board of Directors must also comply with the notice requirements of Securities and Exchange Commission Rule 14a-19(b), including a statement that the shareholder intends to solicit at least 67% of the outstanding voting shares.

Qualifications of Board Members

In selecting individuals for Board membership, the Board of Directors considers a variety of attributes, criteria and factors, including experience, skills, expertise, diversity, personal and professional integrity, character, temperament, business judgment, time availability, dedication and conflicts of interest. At a minimum, director candidates must be at least 18 years of age, have sufficient time to devote to their Board duties and have such business, financial, technological or legal experience or education to enable them to make informed decisions on behalf of the Company. A majority of the Board members must be independent, as determined by the Board of Directors, in accordance with the listing standards of the New York Stock Exchange. In general, the Board affirmatively determines whether a director has any direct or indirect material relationship with the Company. All members of the Audit Committee, Compensation Committee, and Governance and Nominating Committee must be independent, with members of the Audit Committee and the Compensation Committee meeting higher levels of independence as required by the rules of the Securities and Exchange Commission. Members of the Audit Committee must be financially literate as determined by the Board and at least one member must be an Audit Committee Financial Expert as described in the rules of the U.S. Securities and Exchange Commission.

Diversity, Skills and Experience of Directors

Experience & Expertise | Operations Management Experience | Gender/ Ethnic Diversity | CEO Leadership | Industry Background* | Public Company Board Service | Financial Experience | ||||||||||||

Paresh Patel

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

Anthony Saravanos | ✓ |

| ✓ | ✓ | ✓ | ✓ | ||||||||||||

Karin Coleman

| ✓ | ✓ | ✓ | ✓ |

|

| ||||||||||||

Wayne Burks

| ✓ |

|

| ✓ |

| ✓ | ||||||||||||

Jay Madhu

| ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

Gregory Politis | ✓ |

| ✓ | ✓ |

| ✓ | ||||||||||||

Eric Hoffman

|

|

|

| ✓ | ✓ | ✓ | ||||||||||||

Sue Watts

| ✓ | ✓ | ✓ | ✓ |

| ✓ | ||||||||||||

Lauren Valiente

|

| ✓ |

| ✓ |

| ✓ | ||||||||||||

Peter Politis

| ✓ |

| ✓ |

| ✓ | |||||||||||||

*Includes experience in the areas of insurance, technology and real estate.

| HCI Group, Inc. | 11 |

MATTER NO. 1 ELECTION OF DIRECTORS

Diversity and Board Tenure

We believe that a variety of perspectives, opinions and backgrounds among Board members is important to the Board’s ability to perform its duties. Our Board is diverse in terms of gender, ethnicity, culture, education and business backgrounds.

Board tenure diversity is also important, as we seek to achieve an appropriate balance of years of service among Board members. Our senior directors have deep knowledge of our Company and business operations, while new directors provide fresh perspectives. Our current Board of Directors has an average tenure of 8.89.6 years.

Arrangements as to Selection and Nomination of Directors

We are not aware of any arrangements as to the selection and nomination of directors.

Independent Directors

Based upon recommendations of our Governance and Nominating Committee, the Board of Directors has determined that current directors Gregory Politis, Wayne Burks, Eric Hoffman, Jay Madhu, Sue Watts, Lauren Valiente, and Peter Politis are “independent directors” meeting the independence tests set forth in Section 303A.02 of the New York Stock Exchange Listing Manual, including having no material relationship with the Company either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company. In the case of Mr. Hoffman, the Board considered his role as a Senior Managing Director of Centerbridge Partners, which invested $100 million in the Company’s subsidiary, TypTap Insurance Group, and by agreement is entitled to appoint one director to the Company’s Board. In the case of Gregory Politis and Peter Politis, the Board considered their father-son relationship. Finally, in the case of Lauren Valiente, the Board considered her Of Counsel relationship with Foley & Lardner LLP, which provides legal services to the Company. Ms. Valiente provides no legal services to the Company. She is not a partner of the firm. She does not participate in profits at the firm or the fees derived from the Company. The fees Foley & Lardner derives from the Company are a small fraction of the firm’s annual revenues.

Director Election Results

At our 20222023 Annual Meeting of Shareholders, Paresh Patel, GregoryWayne Burks, Jay Madhu, Anthony Saravanos and Peter Politis and Lauren Valiente were re-elected to the Board with vote totals detailed below.

| 2022 | ||||||||

Director Nominee | For | Withheld | ||||||

| Paresh Patel | 97.7 | % | 2.3 | % | ||||

| Gregory Politis | 93.5 | % | 6.5 | % | ||||

| Lauren Valiente | 92.5 | % | 7.5 | % | ||||

| 2023 | ||||||||

Director Nominee | For | Withheld | ||||||

| Wayne Burks | 98.0 | % | 2.0 | % | ||||

| Jay Madhu | 96.0 | % | 4.0 | % | ||||

| Anthony Saravanos | 99.2 | % | 0.8 | % | ||||

| Peter Politis | 97.3 | % | 2.7 | % | ||||

| 12 | HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

Biographies of Directors Standing for Election (Class C)A)

|

| ||||

MATTER NO. 1 ELECTION OF DIRECTORS

|

| |||

MATTER NO. 1 ELECTION OF DIRECTORS

|

| |||

MATTER NO. 1 ELECTION OF DIRECTORS

|

| |||

MATTER NO. 1 ELECTION OF DIRECTORS

Biographies of Directors Continuing in Office

Directors whose present terms continue until 2024 (Class A)

| Karin Coleman | ||||

Karin Coleman, age

Skills/Qualifications: |

Chief Operating Officer President of HCPCI

Committees: - Sustainability | |||

| HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

| Eric Hoffman | |||||

Eric Hoffman, age

Mr. Hoffman graduated summa cum laude with a Bachelor of Science in Economics (concentration in finance and insurance) from the Wharton School at the University of Pennsylvania.

Skills/Qualifications: Mr. Hoffman brings considerable experience, knowledge and education to our Board. In his current position at Centerbridge, he focuses primarily on investments in the financial services sector. His investment experience encompasses financial institutions, insurance and specialty finance companies. In earning his degree from the Wharton School, he concentrated in finance and insurance. His skills at reading and analyzing financial information, and his knowledge of insurance and finance will enhance |

Independent

Committees: - Compensation - Governance & Nominating | ||||

| HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

| Sue Watts | |||||

Sue Watts, age

Skills/Qualifications: Ms. Watts brings to our Board of Directors more than three decades of experience in business operations, information technology and leadership. We believe her knowledge and experience enhance the Board’s oversight of our management, our business operations and the development and application of our technology. |

Independent

Committees: - Governance & Nominating - Audit | ||||

| HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

Biographies of Directors Continuing in Office

Directors whose present terms continue until 2025 (Class B)

| Paresh Patel | |||||

Paresh Patel, age

Skills/Qualifications: Mr. Patel brings to the Board of Directors considerable experience in business, insurance, management, systems and technology, and because of those experiences and his education, he possesses knowledge and analytical and technology skills that are important to the operations of the Company, the oversight of its performance and the evaluation of its future growth opportunities. Furthermore, his performance as chief executive officer has indicated an in-depth understanding of the Company’s insurance business. He is a founder of the Company and has a substantial personal investment in the Company. |

Chairman of the Board and Chief Executive Officer | ||||

| HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

| Gregory Politis | |||||

Gregory Politis, age

Skills/Qualifications: Mr. Politis brings considerable business, management and real estate experience to the Board of Directors. His business and management experience enhances his oversight of the Company’s business performance, as he has a fundamental understanding of business operations. Moreover, real estate experience has become increasingly important to the Company as it considers and makes significant real estate investments. Additionally, Mr. Politis has a substantial personal investment in the Company. |

Independent

Committees: - Compensation (Chair) | ||||

| HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

| Lauren Valiente | |||||

Lauren Valiente, age

Skills/Qualifications: Ms. Valiente brings considerable experience, knowledge and education to our Board, particularly in matters involving regulation of publicly held companies and insurance companies. She will enhance the Board’s oversight of the Company’s compliance with various laws, rules and regulations. |

Independent

Committees: - Sustainability (Chair) - Compensation | ||||

| 18 | HCI Group, Inc.2024 Proxy Statement |

MATTER NO. 1 ELECTION OF DIRECTORS

Directors whose present terms continue until 2026 (Class C)

| Wayne Burks | ||||

Wayne Burks,age 76,has been a director of our Company since June 2013. From October 2019 to June 2021, Mr. Burks served as a director and chair of the Audit Committee for Romark LC, which is a vertically integrated multinational biopharmaceutical company, headquartered in Tampa, Florida. From 2016 until his retirement in July 2019, he served as Romark’s vice president and chief financial officer. From April 2012 to June 2016, he served as a director and the chief financial officer for WRB Enterprises, Inc., a Tampa, Florida based holding company with investments in Caribbean electric utilities, renewable energy development, cable television, real estate and financial institutions. From July 2010 to April 2012, he was a principal of Sterling Financial Consulting where he provided financial and operational consulting services for privately held and pre-initial public offering stage companies. From December 2008 to June 2010, Mr. Burks served as chief financial officer of Prepared Holdings, LLC, a Florida-based insurance holding company. Mr. Burks is a certified public accountant (inactive license). He is a former audit partner of Coopers & Lybrand, where he performed auditing services for approximately 23 years. None of the foregoing companies is an affiliate of HCI Group, Inc. Mr. Burks earned a Bachelor of Science degree in accounting and business administration at Troy University in Alabama. Skills/Qualifications: Mr. Burks brings considerable business, accounting and financial experience to the Board of Directors. We believe his knowledge and experience as the chief financial officer of a homeowners’ insurance company and as an auditor and his ability to analyze financial information enhances the Board’s oversight of the Company’s business operations, its financial disclosure, its external auditors and the effectiveness of our internal controls. Mr. Burks serves as chairman of the Company’s audit committee and has been identified by the Board of directors as an audit committee financial expert. |

Independent Committees: - Audit (Chair) | |||

| HCI Group, Inc.2024 Proxy Statement | 19 |

MATTER NO. 1 ELECTION OF DIRECTORS

| Jay Madhu | ||||

Jay Madhu, age 57, has been a director of our Company since May 2007. From 2008 to 2013, Mr. Madhu served as President of our Real Estate Division and, from 2011 to 2013, he served as our Vice President of Marketing and Investor Relations. Since 2013, Mr. Madhu has been President and Chief Executive Officer of Oxbridge Re Holdings Limited (NASDAQ: OXBR), a Nasdaq-listed reinsurance holding company based in the Cayman Islands and he has served as Oxbridge Re’s Chairman of the Board of Directors since March 2018. From April 2021 to August 2023, Mr. Madhu served as Chairman of the Board, Chief Executive Officer and President of Oxbridge Acquisition Corp. (NASDAQ:OXAC), a Nasdaq-listed blank check company based in the Cayman Islands. Oxbridge Acquisition Corp. merged with Jet.AI Inc. in August 2023. From 2012 to 2014, he served on the Board of Directors for Wheeler Real Estate Investment Trust, Inc., (NASDAQ: WHLR), a Nasdaq-listed real estate investment trust. During 2013, Mr. Madhu served as a director of First Home Bank in Seminole, Florida. As an owner and manager of commercial properties, Mr. Madhu has been President of 5th Avenue Group LC since 2002 and President of Forrest Terrace LC since 1999. He has also been President of The Mortgage Corporation Network (correspondent lenders) since 1996. Prior to that, Mr. Madhu was Vice President, Mortgage Division at First Trust Mortgage & Finance from 1994 to 1996; Vice President, Residential First Mortgage Division at Continental Management Associates Limited, Inc. from 1993 to 1994; and President at S&S Development, Inc. from 1991 to 1993. None of the foregoing companies is an affiliate of HCI Group, Inc. He attended Northwest Missouri State University where he studied marketing and management. Skills/Qualifications: Mr. Madhu brings considerable business, capital markets, marketing, real estate and mortgage finance experience to the Board of Directors. Real estate experience has become increasingly important to the Company as it considers and makes significant real estate investments. Additionally, Mr. Madhu has a substantial personal investment in the Company. |

Other Public Company Boards: - Oxbridge Re Holdings Ltd. - Oxbridge Acquisition Group | |||

| 20 | HCI Group, Inc.2024 Proxy Statement |

MATTER NO. 1 ELECTION OF DIRECTORS

| Anthony Saravanos | ||||

Anthony Saravanos, age 53, has been a director of the Company since May 2007 and president of Greenleaf Capital, LLC, our real estate division, since 2013. Since 2015, Mr. Saravanos has served as Chairman of the Board of BayFirst Financial Corp. (NASDAQ: BAFN) (formerly First Home Bancorp, Inc.), a Nasdaq listed bank holding company headquartered in St. Petersburg, Florida and the parent company of First Home Bank, which provides Small Business Administration loans nationwide. Mr. Saravanos has served as a director of First Home Bank since 2011. Since 2001, he has been the managing partner of several commercial property entities with a combined total of 13 properties in Florida and New York. From 2005 to 2013, Mr. Saravanos served as vice president of The Boardwalk Company, a full-service commercial real estate company, located in Palm Harbor, Florida. From 1997 to 2001, he served as district manager, marketing and sales, for DaimlerChrysler Motors Corporation, Malvern, Pennsylvania. Mr. Saravanos graduated from Ursinus College, Collegeville, Pennsylvania, with a double major in Economics and Spanish. He earned a master’s degree in Business Administration with an emphasis in marketing from Villanova University, where he was inducted into the Beta Gama Sigma Honor Society. Mr. Saravanos also attended Quanaouac Institute, Cuernavaca, Mexico, for intensive Spanish studies and a cultural immersion program. A licensed real estate broker, Mr. Saravanos is a Certified Commercial Investment Member as well as a Certified Development Design and Construction Professional. He was named #1 Top Producer for 2010 by the Florida Gulfcoast Commercial Association of Realtors in the General Brokerage Category. From 2013 to 2020, Mr. Saravanos served as Vice President of Greek Children’s Fund of Florida. From 2018 to 2020, Mr. Saravanos served as a Trustee on the Johns Hopkins Hospital All Children’s Foundation board of directors. Skills/Qualifications: Mr. Saravanos brings considerable business, management, finance, marketing and real estate experience and business education to the Board of Directors. Real estate experience has become increasingly important to the Company as it makes and considers significant real estate investments. As a district manager for DaimlerChrysler Motors Corporation, he was required to read, understand and analyze financial information. His ability to analyze financial information is considered of importance in enhancing oversight of the Company’s performance, monitoring its financial disclosure, and evaluating growth opportunities. Important also, Mr. Saravanos has a substantial personal investment in the Company and he played a large role in bringing initial investors to the Company. |

Director; President of Real Estate Division Committees: - Sustainability Other Public Company Boards: - BayFirst Financial Corp. | |||

| HCI Group, Inc.2024 Proxy Statement | 21 |

MATTER NO. 1 ELECTION OF DIRECTORS

| Peter Politis | ||||

Peter Politis, age 45, joined our Board of directors on June 21, 2021. Mr. Politis is a lawyer. He is the founder of and since 2007 has practiced law under Politis P.A., a boutique law firm located in Clearwater, Florida that focuses on real property acquisitions and financing, construction law, commercial leasing and choice of entity. He is also principal of Xenia Management Company, a real estate development, management and services company located in Clearwater, Florida that owns or manages over 45 properties in the United States, Canada and Greece. Since 2000, he has served in various capacities at Xenia, including as Vice president and General Counsel. Mr. Politis earned a Bachelor of Science degree with a major in Finance and a minor in Economics at the University of Florida in 2001. In addition, he earned a Master of Arts in International Business there in 2002. He earned a Juris Doctor at the University of Miami School of Law in 2004. Peter Politis is the son of Director Gregory Politis. Skills/Qualifications: Mr. Politis brings considerable business, management, legal, and real estate knowledge, education and experience to the Board of Directors. His business and management experience enhances the Board’s oversight of the Company’s business performance, as he has a fundamental understanding of business operations. Moreover, experience in handling legal, financing and business aspects of real estate transactions has become increasingly important to the Company as it considers and makes significant real estate investments |

Independent Committees: - Governance & Nominating (Chair) - Audit | |||

| 22 | HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

Director Compensation

Directors who are employees of the Company do not receive any additional compensation for their service as directors. Our director compensation plan aligns with shareholder interests and market practice. During 2022,2023, each non-employee director received a cash payment of $25,000 per quarter and an annual stock award of 500 shares. Mr. Hoffman has waived his director compensation.

The following table sets forth information with respect to compensation earned by each of our directors (other than employee directors) during the year ended December 31, 2022.2023.

Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Non- qualified Deferred Compensation Earnings | All Other Compensation(3) | Total | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Non- qualified Deferred Compensation Earnings | All Other Compensation(3) | Total | ||||||||||||||||||||||||||||||

Wayne Burks | $ | 100,000 |

| $ | 33,650 |

| — | — | — | $ | 612 |

| $ | 134,262 |

| $ | 100,000 |

| $ | 29,325 |

| — | — | — | $ | 800 |

| $ | 130,125 |

| ||||||||||||||

Eric Hoffman(4) |

| — |

|

| — |

| — | — | — |

| — |

|

| — |

|

| — |

|

| — |

| — | — | — |

| — |

|

| — |

| ||||||||||||||

Jay Madhu | $ | 100,000 |

| $ | 33,650 |

| — | — | — | $ | 612 |

| $ | 134,262 |

| $ | 100,000 |

| $ | 29,325 |

| — | — | — | $ | 800 |

| $ | 130,125 |

| ||||||||||||||

Gregory Politis | $ | 100,000 |

| $ | 33,650 |

| — | — | — | $ | 612 |

| $ | 134,262 |

| $ | 100,000 |

| $ | 29,325 |

| — | — | — | $ | 800 |

| $ | 130,125 |

| ||||||||||||||

Peter Politis | $ | 100,000 |

| $ | 33,650 |

| — | — | — | $ | 612 |

| $ | 134,262 |

| $ | 100,000 |

| $ | 29,325 |

| — | — | — | $ | 800 |

| $ | 130,125 |

| ||||||||||||||

Lauren Valiente | $ | 100,000 |

| $ | 33,650 |

| — | — | — | $ | 612 |

| $ | 134,262 |

| $ | 100,000 |

| $ | 29,325 |

| — | — | — | $ | 800 |

| $ | 130,125 |

| ||||||||||||||

Sue Watts | $ | 100,000 |

| $ | 33,650 |

| — | — | — | $ | 612 |

| $ | 134,262 |

| $ | 100,000 |

| $ | 29,325 |

| — | — | — | $ | 800 |

| $ | 130,125 |

| ||||||||||||||

| (1) | Each director received a cash payment of $25,000 for service during each quarter or portion thereof that he or she served as a director, which includes attendance at Board and committee meetings held during |

| (2) | In accordance with SEC reporting requirements, the amounts reported in this column represent the grant-date fair value of the entire award and were calculated utilizing the fair value recognition provisions of Accounting Standards Codification Topic 718 – “Compensation – Stock Compensation,” which requires the measurement and recognition of compensation for all stock-based awards made to employees and directors, including stock options and restricted stock issuances, based on estimated fair values. The assumptions used in calculating this amount are discussed in Note |

| (3) | All Other Compensation represents dividends paid on unvested restricted shares. |

| (4) | Eric Hoffman was appointed to the HCI Group, Inc. Board of Directors on February 26, 2021 and he waives any compensation from HCI Group, Inc. for serving on the Board of Directors. |

| HCI Group, Inc. | 23 |

MATTER NO. 1 ELECTION OF DIRECTORS

The aggregate number of stock awards outstanding for each non-employee director as of December 31, 20222023 was as follows:

Name | Number of Options | Number of Restricted Shares | ||||

Wayne Burks | — | 500(1) | ||||

Eric Hoffman | — | — | ||||

Jay Madhu | — | 500(1) | ||||

Gregory Politis | — | 500(1) | ||||

Peter Politis | — | 500(1) | ||||

Lauren Valiente | — | 500(1) | ||||

Sue Watts | — | 500(1) | ||||

| (1) | On June |

Principal Shareholders

The following table sets forth information regarding the beneficial ownership of our common stock as of April 12, 202315, 2024 by:

Each person who is known by us to beneficially own more than 5% of our outstanding common stock

Each of our directors and named executive officers

All directors and named executive officers as a group

| 24 | HCI Group, Inc. |

MATTER NO. 1 ELECTION OF DIRECTORS

The number and percentage of shares beneficially owned are based on 8,596,67310,276,413 common shares outstanding as of April 12, 2023.15, 2024. Information with respect to beneficial ownership has been furnished by each director, officer or beneficial owner of more than 5% of our common stock. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission, which generally require that the individual have voting or investment power with respect to the shares. In computing the number of shares beneficially owned by an individual listed below and the percentage ownership of that individual, shares underlying options, warrants and convertible securities held by each individual that are exercisable or convertible within 60 days of April 12, 2023,15, 2024, are deemed owned and outstanding, but are not deemed outstanding for computing the percentage ownership of any other individual. Except as otherwise indicated in the footnotes to this table, or as required by applicable community property laws, all individuals listed have sole voting and investment power for all shares shown as beneficially owned by them. Unless otherwise indicated in the footnotes, the address for each principal shareholder is HCI Group, Inc., 3802 Coconut Palm Drive, Tampa, Florida 33619.

| Beneficially owned | ||||||||

| Name and Address of Beneficial Owner | Number of Shares | Percent | ||||||

Blackrock, Inc.(1) | 1,151,109 | 13.39 | % | |||||

Coastline Square, LLC(2) | 800,000 | 9.31 | % | |||||

Centerbridge Partners LP(3) | 738,750 | 7.91 | % | |||||

The Goldman Sachs Group, Inc.(4) | 618,862 | 7.20 | % | |||||

The Vanguard Group, Inc.(5) | 517,044 | 6.01 | % | |||||

Executive Officers and Directors |

|

|

|

|

|

| ||

Wayne Burks(6) | 8,632 | * | ||||||

Karin Coleman(7) | 82,412 | * | ||||||

Andrew L. Graham(8) | 97,535 | 1.13 | % | |||||

Mark Harmsworth(7) | 86,693 | 1.01 | % | |||||

Eric Hoffman | 0 | * | ||||||

Jay Madhu(9) | 87,791 | 1.02 | % | |||||

Paresh Patel(10) | 1,250,000 | 13.87 | % | |||||

Gregory Politis(11) | 411,882 | 4.79 | % | |||||

Peter Politis(6) | 6,765 | * | ||||||

Anthony Saravanos(12) | 190,173 | 2.21 | % | |||||

Lauren Valiente(6) | 1,194 | * | ||||||

Susan Watts(6) | 6,110 | * | ||||||

All Executive Officers and Directors as a Group (12 individuals) | 2,229,187 | 25.25 | % | |||||

| Beneficially owned | ||||||||

| Name and Address of Beneficial Owner | Number of Shares | Percent | ||||||

Blackrock, Inc.(1) | 1,002,524 | 9.76 | % | |||||

Coastline Square, LLC(2) | 920,000 | 8.95 | % | |||||

Hood River Capital Management, LLC(3) | 712,048 | 6.93 | % | |||||

Executive Officers and Directors |

|

|

|

|

|

| ||

Wayne Burks(4) | 9,132 | * | ||||||

Karin Coleman(5) | 58,762 | * | ||||||

Andrew L. Graham(6) | 57,444 | * | ||||||

Mark Harmsworth(5) | 51,045 | * | ||||||

Eric Hoffman | 0 | * | ||||||

Jay Madhu(7) | 54,791 | * | ||||||

Paresh Patel(8) | 1,434,000 | 13.20 | % | |||||

Gregory Politis(9) | 412,382 | 4.01 | % | |||||

Peter Politis(4) | 7,265 | * | ||||||

Anthony Saravanos(10) | 140,394 | 1.37 | % | |||||

Lauren Valiente(4) | 2,135 | * | ||||||

Susan Watts(4) | 7,280 | * | ||||||

All Executive Officers and Directors as a Group (12 individuals) | 2,234,630 | 20.99 | % | |||||

| * | Less than 1.0%. |

| (1) | This information is based on Schedule 13G/A filed with the Securities and Exchange Commission on January |

| (2) | This information is based on Schedule 13G filed with the Securities and Exchange Commission on January |

| (3) | This information is based on Schedule |

|

|

Includes 500 restricted shares. |

Includes |

Includes |

MATTER NO. 1 ELECTION OF DIRECTORS

Includes |

Includes 447,000 shares held by Paresh & Neha Patel; 37,500 shares held in Mr. Patel’s individual retirement account; |

Includes 200,000 shares held by Gregory & Rena Politis and 500 restricted shares. |

Includes |

| HCI Group, Inc. | 25 |

MATTER NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Company’s Audit Committee has appointed FORVIS, LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023.2024. Shareholders will be asked to ratify the Audit Committee’s appointment at the Annual Meeting. Regardless of the outcome of this vote, the Audit Committee will retain the sole authority to appoint the Company’s independent registered public accounting firm. If the appointment is not ratified, then the Audit Committee will reconsider its appointment. Even if the appointment is ratified, the Audit Committee may appoint a different independent registered public accounting firm for the Company.

Representatives from FORVIS are expected to be present at the Annual Meeting. They will have an opportunity to make a statement and will be available to respond to appropriate questions.

The persons named in the enclosed proxy card intend, unless otherwise directed, to vote such proxy “FOR” ratification of the appointment of FORVIS as the Company’s independent registered public accounting firm. This proposal will be approved if the number of votes for the proposal exceeds the number of votes against the proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF FORVIS, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM — ITEM 2 ON YOUR PROXY CARD. |

Auditing Fees

The following table sets forth the aggregate fees for services provided by Dixon Hughes Goodman, LLP, predecessor to FORVIS, LLP, and FORVIS, LLP related to the years ended December 31, 20222023 and 2021:2022:

2022 | 2021 | 2023 | 2022 | |||||||||||||

Audit Fees(1) | $ | 590,000 | $ | 540,000 | $ | 640,000 | $ | 590,000 | ||||||||

All Other Fees(2) | $ | 420,228 | $ | 182,161 | $ | 150,512 | $ | 420,228 | ||||||||

Total | $ | 1,010,228 | $ | 722,161 | $ | 790,512 | $ | 1,010,228 | ||||||||

| (1) | Audit Fees represent fees billed for professional services rendered for the audit of our annual financial statements, review of our quarterly financial statements included in our quarterly reports on Form 10-Q, and audit services provided in connection with other statutory and regulatory filings. |

| (2) | All Other Fees represent fees billed for services |

accounting for reinsurance provided to others and related intangible assets acquired.

accounting for convertible debt issued.

accounting changes in response to major weather events.

accounting for changed economic conditions.

| 26 | HCI Group, Inc. |

MATTER NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Pre-Approval Policies

All auditing and non-auditing services are pre-approved by the Audit Committee. The Audit Committee delegates this authority to the Chair of the Audit Committee for situations when pre-approval by the full Audit Committee is not convenient. Any decisions made by the Chair of the Audit Committee must be disclosed at the next Audit Committee meeting.

Report of the Audit Committee

To the Board of Directors of HCI Group, Inc.

The Audit Committee oversees the financial reporting processes of HCI Group, Inc. on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee has reviewed the audited financial statements in the Annual Report with management and discussed with management the quality, in addition to the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee has reviewed with representatives of FORVIS, LLP, the Company’s independent registered public accounting firm responsible for auditing the Company’s financial statements and expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States of America, their judgments as to the quality, not just the acceptability, of the Company’s accounting principles. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed under auditing standards adopted by the Public Company Accounting Oversight Board and the U.S. Securities and Exchange Commission. The Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with the independent accountant the independent accountant’s independence.

The Audit Committee has discussed with representatives of FORVIS, LLP the overall scope and plans for their audit. The Audit Committee met with representatives of FORVIS, LLP, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors the inclusion of the audited financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31,

The Audit Committee has appointed FORVIS, LLP, as the Company’s independent registered public accounting firm for the year ending December 31,

AUDIT COMMITTEE Wayne Burks, Chair

Sue Watts

|

| HCI Group, Inc. | 27 |

MATTER NO. 3 APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

We are seeking an advisory vote to approve the compensation of our named executive officers for 2022.2023.

This say-on-pay vote is advisory and non-binding on our Board, but our Compensation Committee will take into consideration the outcome of the vote when making future compensation decisions.

Our Board believes that our current executive compensation program appropriately links the compensation realized by our executive officers to performance and properly aligns the interests of executive officers with those of our shareholders. A description of our executive compensation programs and a discussion of the pay decisions for 20222023 for the Chief Executive Officer and our other named executive officers are included in the Compensation Discussion and Analysis below.

Our Board recommends that our shareholders vote in favor of the following resolution:

“RESOLVED” that the shareholders approve compensation paid to the Company’s named executive officers as disclosed in the Company’s Proxy Statement with respect to the Company’s 20232024 Annual Meeting of Shareholders pursuant to Item 402 of Regulation S-K including the Compensation Discussion and Analysis section, the Summary Compensation Table and other compensation tables and related discussion and disclosure.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT — ITEM 3 ON YOUR PROXY CARD |

| 28 | HCI Group, Inc. |

MATTER NO. 3 APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis included in this Proxy Statement. Based on such review and discussion, the Compensation Committee believes the Compensation Discussion and Analysis represents the intent and actions of the Compensation Committee with regard to executive compensation and has recommended to the Board of Directors that it be included in this Proxy Statement and incorporated by reference into the Company’s Form 10-K for the fiscal year ended December 31,

COMPENSATION COMMITTEE

Lauren Valiente

|

Compensation Discussion and Analysis

The following discussion describes the principal objectives of our executive compensation programs with respect to our named executive officers, outlines the elements of those programs and describes how we believe they meet our objectives. Named executive officers include the chief executive officer, the chief financial officer and the three most highly compensated executive officers. The following individuals served as named executive officers during 2022:2023:

Name and office |

Paresh Patel, Chairman and Chief Executive Officer |

Karin Coleman, Chief Operating Officer, HCI Group, Inc.; President, Homeowners Choice Property & Casualty Insurance Company, Inc. |

Mark Harmsworth, Chief Financial Officer |

Andrew L. Graham, Vice President, General Counsel and Corporate Secretary |

Anthony Saravanos, Divisional President – Real Estate |

Under our Compensation Committee charter, the Compensation Committee has the authority to set the compensation of the named executive officers and to grant equity awards under the Company’s 2012 Omnibus Incentive Plan.

Compensation Highlights

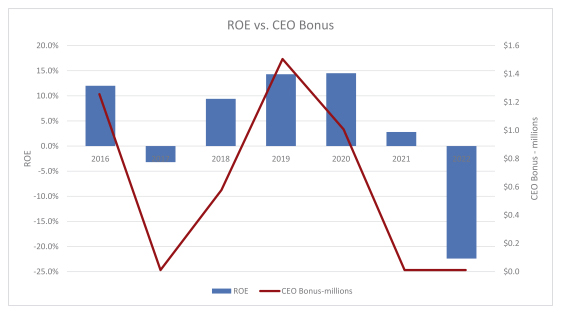

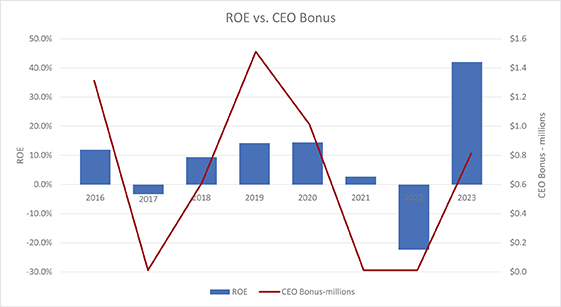

In light2023, HCI reported strong financial results, including $117.7 million of pre-tax income. The Company’s financial performance for the Company’s performanceyear resulted in 2022, the named executive officers received:being awarded a bonus in 2023.

No salary increasesBonuses were based on several key metrics and we believe were commensurate with HCI’s financial performance during the year

No bonusesNamed executives received no significant increase to their salaries

Further, in the view of the Compensation Committee, equity grants awarded in 2021 constitute multi-year, long term incentives negating the value of additional equity compensation during 2022. Those equity grants were made by agreement with Centerbridge Partners, L.P. in conjunction with its $100 million equity investment in the Company.

Principal Objectives and Approach

In designing our executive compensation programs, the Compensation Committee’s principal objectives are to attract and retain highly skilled executives, incentivize executives to achieve strong risk-adjusted returns, and align the interests of our executives with the interests of our shareholders. Our compensation plans are designed to incentivize executive behavior that drives positive financial performance, which leads to increased shareholder returns.

The Compensation Committee uses a common-sense approach to setting executive compensation. It considers objective measures of business performance as well as the judgment and knowledge of Committee members as to the talents, work habits and contributions of our executive officers. The Company’s financial performance and progress on its strategic goals are important factors in our compensation decisions.

| HCI Group, Inc. | 29 |

MATTER NO. 3 APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The Company has delivered positive financial results over the long-term, however the Committee understands that financial performance may vary from year to year depending on many factors including hurricanes and other weather events. While hurricanes are a factor our management cannot control, management can control how the Company prepares for and responds to these events. In the opinion of the Compensation Committee, the Company’s response to the hurricanes and tropical storms of the past several storm seasons was well-planned and well-executed.

Elements of Executive Compensation

The Compensation Committee uses a balanced set of pay elements to determine executive compensation levels, including base salaries, short-term cash performance bonuses and long-term equity incentives comprised of restricted stock awards and, in the case of the chief executive officer, stock purchase option awards. We believe these elements create appropriate incentives for driving strong corporate performance, align the interests of our executives with those of our shareholders, and enable us to retain and reward outstanding executive talent.

Restricted stock awards may vest over time or if the Company stock price reaches certain target levels. In either case, the awards create a significant incentive for achieving long-term financial and strategic goals and serve to retain talented executives. When determining equity awards, the Committee considers competitive market dynamics, peer-group compensation levels and the Company’s overall financial performance.

The Compensation Committee believes that reducing cash bonus compensation in favor of equity linked compensation further enhances alignment between our management team and our shareholders.

The compensation program for our chief executive officer is designed to reward outstanding performance and align pay with the interests of shareholders. During 2022,2023, our chief executive officer was paid only a base salary with no bonus or additionaland was granted a stock option award. Certain financial targets must be achieved for the stock option awards of equity. to vest. Additionally, the stock option awards include certain clawback provisions.

The chief executive officer’s 20222023 compensation was consistent with our long-term incentive program, which included one-time multi-year grants awarded in 2021, as well as a discretionary bonus tied to the overall profitability of HCI Group.

Benchmarking

To attract and retain key executives, we carefully consider our market environment when setting pay levels for our executives, recognizing that we are in a highly competitive industry in which talented people are a significant driver of value.

The company’sCompany’s incentive program was designed using two groups of peer companies representing the principal potential talent market: the property and casualty insurance industry and the software industry. While the Company’s primary business is property and casualty insurance, its success relies on the internal development and implementation of custom software. The two peer groups comprise the following companies:

Insurance Industry

Amerisafe Inc.

*Heritage Insurance Holding, Inc.

Investors Title Company

Kinsale Capital Group

Lemonade, Inc.

NI Holdings, Inc.

Palomar Holdings, Inc.

Protective Insurance Corporation

*

*Universal Insurance Holdings, Inc.

|

Software Industry

American Software, Inc.

AppFolio, Inc.

MicroStrategy Incorporated

Q2 Holdings,

Qualys, Inc.

|

| * | Member of Core Peer Group. |

| 30 | HCI Group, Inc. |

MATTER NO. 3 APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The companies within each peer group are all U.S.-based publicly held companies similar in size to our Company.

While all companies in the above groups were used to design the compensation program, each year, the Compensation Committee benchmarks compensation using a core peer group of publicly held property and casualty insurance companies based in Florida (the Core Peer Group) because these companies are similar to us in terms of insurance services and market opportunity. The members of the Core Peer Group are indicated in the table above. The Committee reviews the compensation, financial performance and shareholder returns of these core peer companies when finalizing the total compensation award for our chief executive officer. The cash bonus and total compensation for our CEO may be higher or lower than the target reference point for chief executive officers in the Core Peer Group because of factors such as performance and retention, as well as size and complexity of the job.

The following table shows the compensation of chief executive officers in our core peer group based on the disclosures in their proxy statements.

| (in $ thousands) | ||||||||||||||||||||||||

Company | Salary | Cash Bonus | Stock Awards | Equity Options Awards | Other | Total Compensation | ||||||||||||||||||

2022 HCI | $ | 950.0 | $ | — | $ | — | $ | — | $ | 81.1 | $ | 1,031.1 | ||||||||||||

2021 HCI | $ | 734.6 | $ | — | $ | 1,323.5 | $ | 5,550.0 | $ | 128.6 | $ | 7,736.7 | ||||||||||||

FedNat Holding Company – 2021 | $ | 1,000.0 | $ | — | $ | 252.0 | $ | — | $ | 17.4 | $ | 1,269.4 | ||||||||||||

Heritage Insurance Holdings, Inc. – 2021 | $ | 1,000.0 | $ | 740.0 | $ | 1,250.0 | $ | — | $ | 24.3 | $ | 3,014.3 | ||||||||||||

United Insurance Holdings Corp. – 2021 | $ | 150.0 | $ | — | $ | 29.4 | $ | — | $ | 1.2 | $ | 180.6 | ||||||||||||

Universal Insurance Holdings, Inc. – 2021 | $ | 1,000.0 | $ | — | $ | 1,468.0 | $ | 1,000.0 | $ | 72.5 | $ | 3,540.5 | ||||||||||||

| (in $ thousands) | ||||||||||||||||||||||||

Company | Salary | Cash Bonus | Stock Awards | Equity Options Awards | Other | Total Compensation | ||||||||||||||||||

2023 HCI | $ | 950.0 | $ | 800.0 | $ | — | $ | 1,875.0 | $ | 37.8 | $ | 3,662.8 | ||||||||||||

2022 HCI | $ | 950.0 | $ | — | $ | — | $ | — | $ | 81.1 | $ | 1,031.1 | ||||||||||||

American Coastal Insurance Corporation – 2023 | $ | 150.0 | $ | — | $ | 26.3 | $ | — | $ | — | $ | 176.3 | ||||||||||||

Heritage Insurance Holdings, Inc. – 2022 | $ | 1,023.4 | $ | — | $ | 1,000 | $ | — | $ | 342.1 | $ | 2,365.5 | ||||||||||||

Universal Insurance Holdings, Inc. – 2022 | $ | 1,000.0 | $ | — | $ | 750.0 | $ | 307.8 | $ | 1,520.6 | $ | 3,578.4 | ||||||||||||

The following table summarizes the share price performance and dividend payouts of companies in our Core Peer Group based on the disclosures in their filings with the Securities and Exchange Commission.

Company | 12/31/2022 Market Cap | 12/31/2021 Stock Price | 12/31/2022 Stock Price | % Change | 2022 Dividends per Share | 12/31/2023 Market Cap | 12/31/2022 Stock Price | 12/31/2023 Stock Price | % Change | 2023 Dividends per Share | ||||||||||||||||||||||||||||||

HCI Group, Inc. | $ | 340.4 | $ | 83.54 | $ | 39.59 | -53 | % | $ | 1.60 | $ | 851.1 | $ | 39.59 | $ | 87.40 | 121 | % | $ | 1.60 | ||||||||||||||||||||

FedNat Holding Company | $ | — | $ | 1.41 | $ | 0.00 | -100 | % | — | |||||||||||||||||||||||||||||||

American Coastal Insurance Corporation | $ | 442.5 | $ | 1.06 | $ | 9.46 | 792 | % | — | |||||||||||||||||||||||||||||||

Heritage Insurance Holdings, Inc. | $ | 46.0 | $ | 5.88 | $ | 1.80 | -69 | % | $ | 0.12 | $ | 197.0 | $ | 1.80 | $ | 6.52 | 262 | % | — | |||||||||||||||||||||

United Insurance Holdings Corp. | $ | 45.9 | $ | 4.34 | $ | 1.06 | -76 | % | $ | 0.06 | ||||||||||||||||||||||||||||||

Universal Insurance Holdings, Inc. | $ | 321.8 | $ | 17.00 | $ | 10.59 | -38 | % | $ | 0.77 | $ | 462.9 | $ | 10.59 | $ | 15.98 | 51 | % | $ | 0.77 | ||||||||||||||||||||

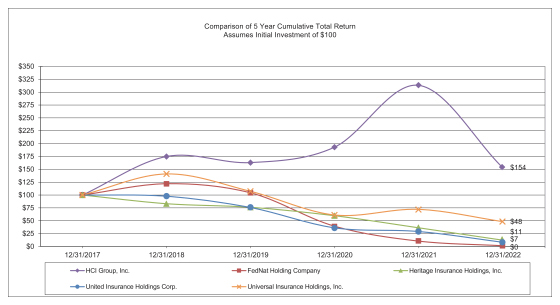

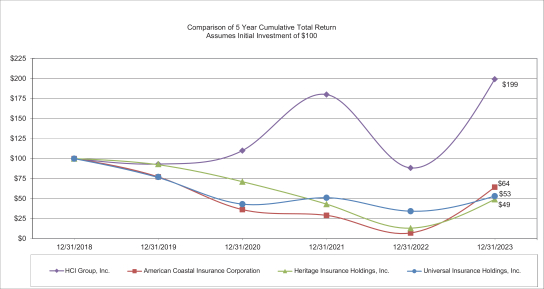

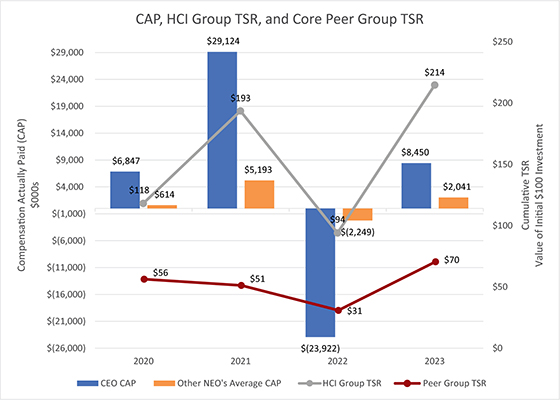

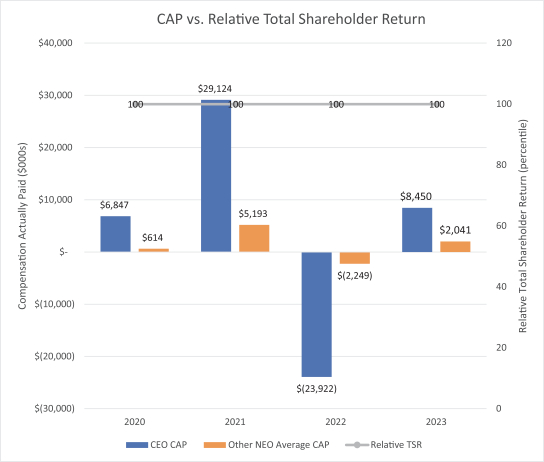

The Company’s share price performance and record of consistent dividend payments have provided solid returns to shareholders, both in absolute terms and relative to the Company’s core peer group. The illustration below shows that the total shareholder return of HCI shares over the past five years was 54%99% compared with a negative return for the Company’s core peer group over the same period. The Compensation Committee views total shareholder return as highly indicative of companyCompany performance over the long-term.

| HCI Group, Inc. | 31 |

MATTER NO. 3 APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Comparison of HCI to its core peer group using total shareholder return for the last five years:

Role of the Board of Directors, Management and Consultants in Compensation Decisions

The Compensation Committee views the determination of compensation as a collaborative effort, and it welcomes and seeks input from executive officers, other directors and shareholders.

At least annually, before executive compensation is set for the year, the Compensation Committee discusses its compensation philosophy with the full Board of Directors and briefs the Board of Directors on the structure of the Company’s executive compensation programs. The Chair reports to the Committee and the Board of Directors any material issues raised during shareholder discussions, and the Committee and the Board of Directors, in good faith, address those issues.

In setting compensation for the named executive officers other than the chief executive officer, the Compensation Committee invites the chief executive officer to present his evaluation of each named executive officer’s performance

during the year and provide recommendations regarding each executive’s base salary, performance bonus and equity compensation. The Committee has full authority to accept, modify or reject these recommendations.

The Compensation Committee discusses the chief executive officer’s compensation and related proposals with him. Decisions regarding the chief executive officer’s compensation are made by the Committee and reviewed by the Board without Mr. Patel present.

To assist in determiningSince 2021, compensation decisions have been governed by the compensation of our chief executive officer and named executive officers, the Company periodically engages the services of leading compensation advisory firms. In 2020, following discussion with shareholders, the Compensation Committee undertook an assessmentterms of the compensation program for the chief executive officerCenterbridge investment and our named executive officersare subject to their approval. This includes salary adjustments, bonuses, and retained Pearl Meyer, a leading executive compensation firm, to assist with this review. The purpose of the review was to understand current best practices in compensation design and to identify areas where the Company’s pay programs can be improved in order to strengthen alignment with shareholder interests and promote the long-term success of our strategy.new employment contracts.

Compensation Committee Engagement with Shareholders

The Compensation Committee considers the opinions of shareholders in making compensation decisions. Each year we engage with our shareholders at least twice – once during the “off season” and once prior to proxy voting. The purpose of the “off-season” conference calls is to understand investor perspectives regarding compensation, governance and any additional matters, and to update shareholders on our compensation and governance initiatives.

| 32 | HCI Group, Inc. |

MATTER NO. 3 APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

In 2022,For 2023, we reached out to shareholders representing approximately 78%65% of our outstanding common stock. A Board member and our investor relations staff spoke with 23 shareholders representing approximately 55%32% of the Company’s outstanding common stock. To assist with our shareholder engagement program, we have retained the proxy advisory firm, Alliance Advisors.

In 2022, 66%2023, 98% of shareholders approved, on an advisory basis, of compensation paid to our named executive officers. Following this result, we responded by increasing our level of engagement with a focus on gathering feedback from key shareholders to explore their views on executive compensation. Shareholders were largely supportive of ourthe improved disclosure on executive compensation, program but wantedincluding our decision to better understandnot pay bonuses or implement salary increases for the nature ofnamed executives in 2022, as well as, added disclosure around multi-year grants awarded in 2021 under our long-term incentive program. Shareholders also wanted insight into our evaluation2021.

For 2023, shareholders were largely supportive of alternative performance-based compensation frameworks. In response, we took the following actions in 2022:

|

We commissioned an internal study to investigate alternatives to HCI’s existing performance-based pay structure, including relative total shareholder return, among other metrics.

We made no increases to base salary, paid no bonuses anda stock option award granted no additional equity to our named executive officersCEO in 2022, consistentSeptember when our stock price was approximately $52. The award was well aligned with our long-term compensation plan.shareholders as the options would vest only if the share price exceeded $80 for 20 consecutive trading days. This condition was met in December 2023.

The Compensation Committee believes that additional disclosure last year around our multi-year awards under our long-term compensation program, the absence of any new awards in 2022, and the steps taken this year to evaluate new performance-based pay structures constitute meaningful action aimed at addressing concerns raised by shareholders in 2022.prior years. We look forward to continuing an active dialog with our shareholders through our ongoing outreach efforts.

20222023 Company Performance

Progress towards the Company’s financial and strategic goals drive our compensation decisions. Measuring performance is inherently subjective and includes the evaluation of both financial and nonfinancial factors including the Company’s success in advancing strategic initiatives, responding to hurricanes and other catastrophic events, and satisfying policyholders and regulators.

No formula or set of metrics can properly measure all aspects of our company’sCompany’s performance in a given year. Therefore, the Compensation Committee retains discretion in awarding cash, equity and other benefits to executives.